Feb 14, 2021 | Limited Companies, Self Employment in UK, Uncategorised, VAT Returns

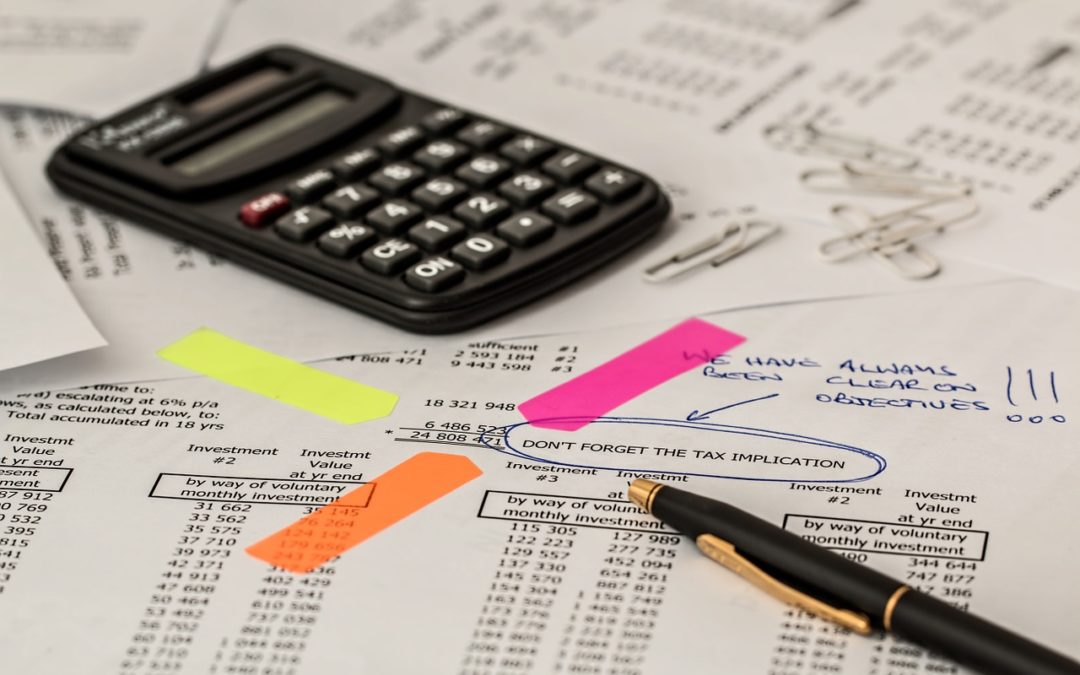

VAT – Flat Rate Scheme What is it? VAT is calculated as a difference between VAT from sales (output VAT) and VAT from purchases (input VAT). Sometimes a person has a refund of VAT, but many times owes Vat to HMRC. Flat Rate Scheme is a set % of VAT that has to be...

Dec 6, 2020 | Limited Companies, Self Employment in UK, Uncategorised, VAT Returns

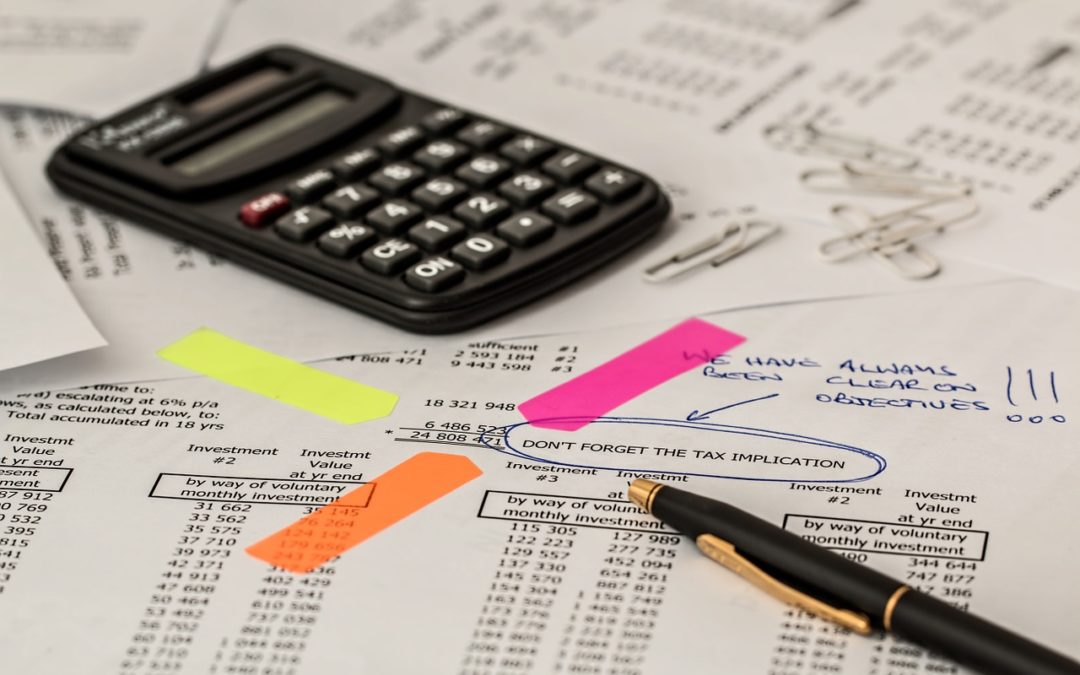

What is business entertainment and can we classify it as business expenses? What is classified as a business entertainment in relation to the clients: Food and drink Presents Cinema or theatre tickets Sports events tickets Entries to the clubs One would think that if...

Oct 20, 2020 | Construction Industry Scheme (CIS), Limited Companies, Payroll, Self Employment in UK, VAT Returns

In England most of self-employed people or directors of Ltd companies using advice and services of the accountant. Do you know that one does not have to have relevant qualifications to call themselves accountant or that you, as a client, are responsible for the...